There has been, and will continue to be, a lot of conversation and press around cookies, mobile IDs, privacy, and privacy regulation surrounding digital advertising.

The news and the urgency around the news will come and go in fits and spurts. Here, we’ll explore a more relaxed view of what is coming, (approximately) when it’s coming, and what steps advertisers can take to future-proof their businesses.

First things first, cookies are going away. Apple is forcing dramatic changes to their version of the mobile ID (IDFA). Much of the digital world has been built, and currently operates, on cookies and mobile IDs. They are the infrastructure that enable most modern marketing digital advertising capabilities:

- Retargeting

- Targeting with 3rd party data

- Controlling targeting based on consumer recency

- Frequency controls

- Message sequencing

- Lookalike modeling

- Measurement & attribution of digital advertising

- Algorithmic optimization

- Insight generation against 3rd party data sets

All of the above are “at-risk” capabilities with the changing digital infrastructure. It might read like an apocalyptic thrust back to the dark ages, but understand:

1. The changes in digital infrastructure are a dimmer switch, not an off switch. In fact, the digital infrastructure that helps us meet the capabilities listed above have been evolving consistently for years.

2. There will be ways to maintain the capabilities powered by cookies, mobile IDs, and other shifting infrastructure. The mechanisms will be different, but the end results will be the same – just a more complex way to get there.

The Dimmer Switch is Slowly Fading on Unconsented Digital Tracking

The reason for all these shifts is rooted in the constant march toward greater and greater consumer choice and control. It is because of progress, and it is hard—and unwise—to bet against progress over time. Here is some high-level perspective to help set appropriate urgency.

1. Cookies. Apple’s Safari and Mozilla’s Firefox have been adding tracking prevention and blocking many cookies in their browsers for years. Google’s Chrome, the largest browser in the U.S., will be sunsetting cookies at some point in 2022.

2. Mobile IDs. Apple, at about 60% mobile phone share in the U.S., will require consumers to explicitly opt-in to collecting and sharing their data for advertising purposes, likely this Spring. We expect low, but some, adoption. Google’s Android, with roughly the other 40% share of the U.S. mobile phone market, has made no such announcements yet.

3. Regulation.CCPA is the largest regulation in effect in the U.S. and there is a patchwork of other state legislation as well (Nevada, Maine, others being drafted). There is general industry desire for federal (versus state-by-state) regulation to make adherence less complicated and costly for business. We believe more regulation will slowly become reality first in a few additional states and later federally. Timing is uncertain.

4. Technical Workarounds.There are technical workarounds, like “fingerprinting,” that can achieve many of the same results in capability as cookies or mobile IDs. Ultimately, we believe these efforts will be short-lived without the ability to gain consumer consent and offer consumer control. Major technology players, namely Google and Apple, are actively working against and recommending against using these types of workarounds.

What the Future Looks Like

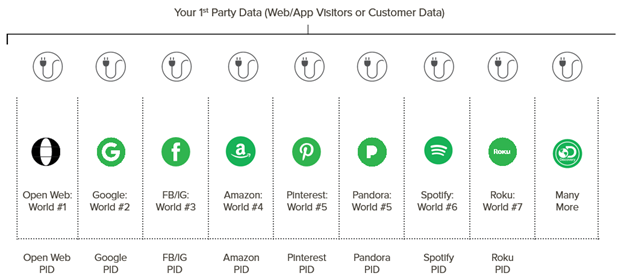

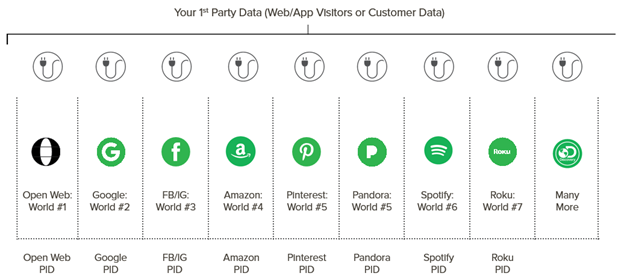

Our belief is that the future will feature more and larger walled gardens. The major platforms and publishers will have their own solutions to replicate at-risk digital capabilities within their individual walled garden. They will be able to offer them because of their explicit consumer consent and persistent IDs across devices (logged-in users). Here is a visual:

In this future, it seems very likely that the (formerly) “open” web will look and feel like its own walled garden. The persistent IDs within that ecosystem might be browser-based, might be driven by an industry consortium, or might be an interchangeable set of anonymized identity currencies coming together in a plug-and-play type environment. Yes, a lot is still in motion on this front.

Overall, it is worth noting the accelerating trend toward more walled gardens. On the consumer side, people are spending more and more time inside of walled gardens versus the open web. According to Nielsen Media Institute data, the share of consumer time spent in walled gardens (like Facebook, Google, YouTube, Snapchat, etc.) is stealing 2-4% of that total time from the “open web” each year. We expect a hockey stick of growth on that front this year, with walled garden time surpassing open web time and never looking back. That’s due to consumer behavior, but also because of the open web properties converting to walled gardens themselves.

On the content side, streaming services from major video media companies (Discovery, NBC Universal, Disney, etc.) and ring-fenced content from major print media companies (Meredith, Conde Nast, Hearst, etc.) are some of the latest walled gardens on the scene, each with the ability to require logged-in experiences across the many different access points to their content brands.

What Advertisers Can Do

There are two main areas to focus efforts on as the dimmer switch fades:1. Reprioritize contextual advertising – where the context of the user’s media experience serves as the bridge to that consumer’s state-of-mind.

2. Build up the depth and breadth of 1st party assets, specifically gaining consumer consent to tracking and using their data.

Contextual Advertising is “In-the-Moment” Behavioral Advertising

There will be a rightful resurgence of contextual targeting. Pretend an advertiser sells basketball shoes. Rather than using behavioral targeting segments of “basketball interest” or “in-market for basketball shoes” to follow them around with basketball shoe advertising, contextual advertising would find specific content (articles, images, videos, audio clips) about basketball and put ads in and around that specific content.

It’s a simple concept that feels like a relic of the past, but technology is making this easier to do at scale and across formats (text, image, and audio/video). It’s smart to have a focus here on what is possible now and coming soon to the space.

Contextual advertising can help find the right consumers in a relevant place, but it falls short of replacing other important digital capabilities – specifically, measurement or attribution.

First-Party Data Re-enables the Full Set of Digital Capabilities

1st party data from website visitors, app users, and customer lists (CRM) will be critical to the future capability of each individual advertiser. 1st party data will work like a currency, enabling the secure comparison of audiences from the advertiser to other publishers, platforms, panels, or other advertisers. With this 1st party data currency, the full set of digital capabilities are reborn in new and potentially differentiating way for the advertiser.

Your 1st Party Data will individually plug into each walled garden, as shown below. It will also enable some digital capabilities across gardens – like measurement/attribution, setting frequency ceilings or recency controls, and orchestrating consumer message sequencing.

Impact to Measurement

The future of measurement without cookies and device IDs might end up being more accurate than the ways of the past. There are three main areas of focus.

1. Projections. As the dimmer switch fades on old digital infrastructures, the (false) promise of the past – that every conversion can be counted individually – will be replaced by a world of machine learning and conversion projections to fill in the blanks on untrackable audiences.

2. Sandboxes. Many of the “walled gardens” will have their own sandboxes or clean rooms to play in. These environments will be good for understanding performance and audience insights within those individual walled gardens. They will largely ignore the need to also understand impact from other ads shown to those same audiences outside of their walled garden.

3. 1st Party Data. 1st party data will be the ultimate source for leveling the playing field across different walled gardens’ projection math and sandbox environments. By controlling the 1st party audiences sent into each walled garden, advertisers can measure the impact coming from each walled garden, both against one another and against a control.

The Future Shows Promise

Progress toward personal consent and control is driving significant change and complexity in the worlds of content, technology, regulation, and advertising. Over the course of this year and next, advertisers will have the requirement to build or re-build some new muscle memory. Specifically, there should be a focus on contextual advertising partnerships/capabilities and building up 1st party data assets. Doing those two things well will mitigate much of the risk imposed by the evolutions underway in digital advertising.

We believe that the mid-term future (2-5 years) will be very complex, requiring sophisticated orchestration of 1st party data assets across numerous walled garden media environments.

Looking beyond that, we believe that this complexity will eventually lead to a greater and simpler future – a future of convergence. Thus, we’re referring to it as Advertising’s Great Convergence, where the same progressive forces driving the changes in technology today will empower new technologies that pull everything together in a bigger, better, easier way in the future. More to come on Advertising’s Great Convergence in future articles. Stay tuned!